As U.S. tariffs mount, China’s top trade provinces fast-track counterstrategies

"Not putting all eggs in one basket"

Amid the Trump administration’s relentless push to impose additional tariffs on Chinese goods, local governments across China are ramping up responsive measures.

According to a report from the WeChat blog of "国是直通车” (China News Express), a media brand of China News Service (CNS), provinces and cities—including Guangdong, Jiangsu, Zhejiang, Shandong, Fujian, Sichuan, Hunan, Beijing, Shanghai, and Tianjin—have been holding meetings and conducting research to assess the impact on foreign trade enterprises, while rolling out supportive policies.

The coverage highlights three key aspects of these local preparations: the main points from government discussions, regional strategies to counter U.S. tariff pressures, and concrete policy responses.

In another article, the WeChat blog of "政知见” (Political Insight) under Beijing youth Daily noted that since the U.S. imposed so-called "reciprocal tariffs," Zhejiang’s provincial party secretary and governor have addressed foreign trade stabilization measures three times within a single week. Zhejiang, a major hub for China’s exports, underscores the urgency of these efforts.

Meanwhile, the WeChat blog 国民经略 "National Economic Strategy" published a detailed analysis of Chinese cities most reliant on foreign trade, offering deeper insights into regional vulnerabilities and adaptations.

Together, these reports provide a comprehensive look at the current state of China’s foreign trade landscape, its regional disparities, and the broader strategic response to Trump’s tariff policies. In today’s newsletter, I break down the key points from the pieces mentioned above from "国是直通车” (China News Express) and 国民经略 "National Economic Strategy" —great for anyone who wants a deeper look.

But if two paragraphs could sum it all up, it might be the ones from a recent New York Times guest essay piece: “Trump Has Botched His Tariff War With China” written by Robert Wu, the founder and chief executive of BigOne Lab, a Chinese data-driven research company based in Shanghai. He also writes for his Baiguan and China Translated newsletters:

But China has been diversifying its export markets to reduce its dependence on the United States: The value of direct Chinese exports to the United States last year was roughly the same as a decade ago; its exports to the European Union, meanwhile, soared in that period. China also has reduced its overall reliance on trade: Exports as a percentage of China’s gross domestic product declined from 36 percent in 2006 to 19.7 percent in 2023, according to World Bank data.

……

China’s leaders are simply not as vulnerable to domestic pressure as Mr. Trump. This has deep historical, cultural and social roots. Recurring periods of hardship in Chinese history have embedded in the nation’s psyche a capacity for endurance and fortitude. The phrase for this is “chi ku,” or to “eat bitterness.” Younger Chinese today are accustomed to more comfortable consumer lives than previous generations, but chi ku still runs strong.

The following part is from "国是直通车” (China News Express)

1. What are the key points of the intensive discussions and research?

After the U.S. government announced the imposition of "reciprocal tariffs" on Chinese goods, the principal leaders of Zhejiang, Jiangsu, Tianjin, Hunan, and other regions held discussions and research with some enterprises.

Institutions and organizations such as the Beijing Development and Reform Commission and the Shenzhen Service Trade Association, as well as grassroots governments such as Pujiang County in Jinhua City and Guzhen Town in Zhongshan City, also held symposiums to listen to the suggestions of foreign trade enterprises face-to-face.

These discussions and research were held frequently.

From April 8 to 9, April 10, April 12, and April 14, Wang Hao, the secretary of the Zhejiang Provincial Party Committee, and Liu Jie, the governor of Zhejiang Province, deployed issues related to stabilizing foreign trade four times within a week through symposiums, research, and work meetings.

During the discussions, research, and work meetings in various regions, there were two key points:

The first is "confidence".

During a discussion with Hunan provincial governor Mao Weiming, some enterprises mentioned that the U.S.'s multiple rounds of tariff increases would inevitably have a negative impact on the export of some products in the short term, bringing instability and uncertainty to economic operations.

Mao Weiming responded that in the face of pressure, we must always maintain confidence and courage to become stronger under pressure.

Wang Hao, the secretary of the Zhejiang provincial Party committee, stated that the more complex and changing the situation is, the more we need to strengthen our confidence.

The second is "acceleration".

Wang Hao called for accelerating the creation of an open business environment that offers optimal services, lowest costs, and highest efficiency.

A Zhejiang provincial executive meeting held on April 12 proposed expediting the implementation and stockpiling of policy tools, enhancing the overseas service support system, and assisting enterprises in exploring diversified markets.

A fact-finding mission in Shanghai’s Huangpu District revealed that early implementation of targeted support policies and timely disbursement of financial assistance could help mitigate the challenges faced by affected foreign-funded and foreign trade enterprises.

A Shenzhen municipal Party standing committee meeting on April 10 stressed the need to act with the utmost urgency, prioritize market expansion, and take proactive, strong, and effective measures to support enterprises in vigorously exploring both domestic and international markets.

2. What are the local-level strategies for coping with current challenges?

The core focus of local foreign trade policies can be summarized as: expanding diversified markets and promoting integrated development of domestic and foreign trade. Specifically, these efforts are centered around expanding overseas markets and tapping domestic market potential.

In terms of overseas market expansion, two important pathways have emerged:

(1) Emerging markets Shanghai’s Jinshan District is supporting enterprises in expanding their reach into emerging markets, particularly ASEAN, the Middle East, and Latin America. Starting this year, Dongguan will organize enterprises to participate in over 200 key overseas exhibitions annually, including at least 100 in emerging markets. Around 2,000 companies will also be mobilized to join nearly 20 domestic “Guangdong Trade Nationwide” exhibitions.

(2) Cross-border e-commerce platforms Cross-border e-commerce has become a new growth engine for foreign trade. During his inspection, Jiangsu governor Xu Kunlin emphasized the importance of developing cross-border e-commerce as a breakthrough area. He proposed enhancing services such as startup incubation, brand marketing, website development, and cross-border livestreaming, to foster a stronger cohort of cross-border e-commerce enterprises and indigenous brands and to cultivate specialized industrial clusters.

Shandong also aims to build 20 specialized cross-border e-commerce industrial belts, nurture 100 internationally competitive brands, and incubate 1,000 emerging cross-border e-commerce enterprises in 2024.

In terms of domestic market development, the focus lies in strengthening distribution channels. Local governments and relevant organizations have played a coordinating role as a bridge. The Sichuan provincial department of commerce has mobilized state-owned, private, and foreign-invested enterprises in the province, as well as business associations, to launch targeted support programs, build omni-channel sales networks, establish dedicated sales zones, and publish direct contact numbers to assist foreign trade enterprises in expanding domestic sales. Efforts are also underway to support household appliance and digital product companies in participating in consumption-boosting campaigns such as “old-for-new” product exchanges. The Jiangsu Commercial Association initiated a proposal to “actively expand domestic sales channels for foreign trade products and promote the new development paradigm of dual circulation.” It pledged assistance in areas such as product sourcing, shelf placement, financial settlement, and marketing for affected enterprises, while encouraging trade associations to mobilize commercial circulation firms to coordinate responses.

3. What concrete measures have been introduced?

(1) Building platforms

During the 137th China Import and Export Fair (Canton Fair), Guangzhou will host a matchmaking event connecting foreign trade products with domestic buyers, inviting over 200 participating exhibitors and integrated domestic-foreign trade companies to meet with more than 200 domestic purchasers. According to the Sichuan Provincial Department of Commerce, the province is actively building platforms for enterprises facing export difficulties by mobilizing local supermarkets and e-commerce platforms to help enterprises shift to domestic sales. It also plans to establish a demand database, enterprise directory, and product catalogue, and to organize targeted matchmaking events to help businesses explore the domestic market. The Zhejiang Council for the Promotion of International Trade has launched a signature service program, “International Trade and Investment Delegation Zhejiang Tour,” which now emphasizes a two-way strategy of “bringing in” as well as “going global,” creating a platform for international economic and trade exchanges right on the doorstep.

(2) Policy formulation Targeted policies can help enterprises cut costs and improve efficiency. For example, Guangzhou will roll out policies to support the shift of quality foreign trade products to domestic sales, offering assistance in areas such as alignment of domestic and foreign standards, product inspection and certification, intellectual property protection, credit insurance, and brand development. Jinshan District in Shanghai is planning to work with customs and other departments to offer policy support and facilitate business operations. Dongguan will pilot measures such as “customs-enterprise coordination,” “appointment-based customs clearance,” and “cross-district returns,” aiming to reduce inspection time for key goods. Fujian Province is targeting the elimination of market barriers. Its draft action plan on promoting integrated domestic and foreign trade proposes breaking down local protectionism and market segmentation, conducting market access efficiency evaluations across all provincial, municipal, and county levels by the end of 2025, and dismantling over 100 hidden barriers.

(3) Financial and operational support Jiangsu and Hunan have both pledged to adopt a “one industry, one policy” and “one enterprise, one solution” approach to address specific challenges. Many localities have introduced concrete measures. For example, in Yangjiang City, Guangdong Province, foreign trade enterprises participating in exhibitions in Belt and Road partner countries, RCEP member states, and the Middle East can receive up to 50% reimbursement on booth rental, decoration, and airfare expenses. The same level of support will also be available for enterprises shifting to domestic sales. Nansha District in Guangzhou encourages platform enterprises to pursue digital transformation and will provide up to 20 million yuan in support for those that significantly boost transaction volume. Dongguan will offer up to 5 million yuan in support for enterprises that purchase short-term export credit insurance, helping mitigate risks as they expand internationally.

(4) Providing services Foreign trade enterprises often face numerous specific and detailed challenges in expanding into domestic and overseas markets. Many localities have launched service initiatives in response. For example, after the Sichuan Chain Store and Franchise Association published contact information to support enterprises transitioning to domestic sales, it received a flood of inquiries on the same day. Many foreign trade enterprises lacked knowledge of supply chain procedures and entry requirements, and faced challenges such as adjusting product codes and specifications. The association, together with local retailers, quickly drafted implementation plans and began organizing themed training sessions, inviting economic experts and retail executives to deliver targeted guidance. Meanwhile, the Xiamen Municipal Bureau of Commerce launched the “Xiamen Foreign Trade Enterprises Hotline,” providing comprehensive services including policy consultation, appeal handling, and professional guidance for local enterprises.

The following part is from 国民经略 "National Economic Strategy"

Foreign trade dependence, typically measured by the ratio of total imports and exports to GDP, serves as an indicator of a region's degree of openness to the international economy.

A higher level of foreign trade dependence indicates a greater degree of integration with global markets and a stronger link to international economic dynamics. However, it also implies greater exposure to fluctuations in the global political, economic, and geopolitical environment.

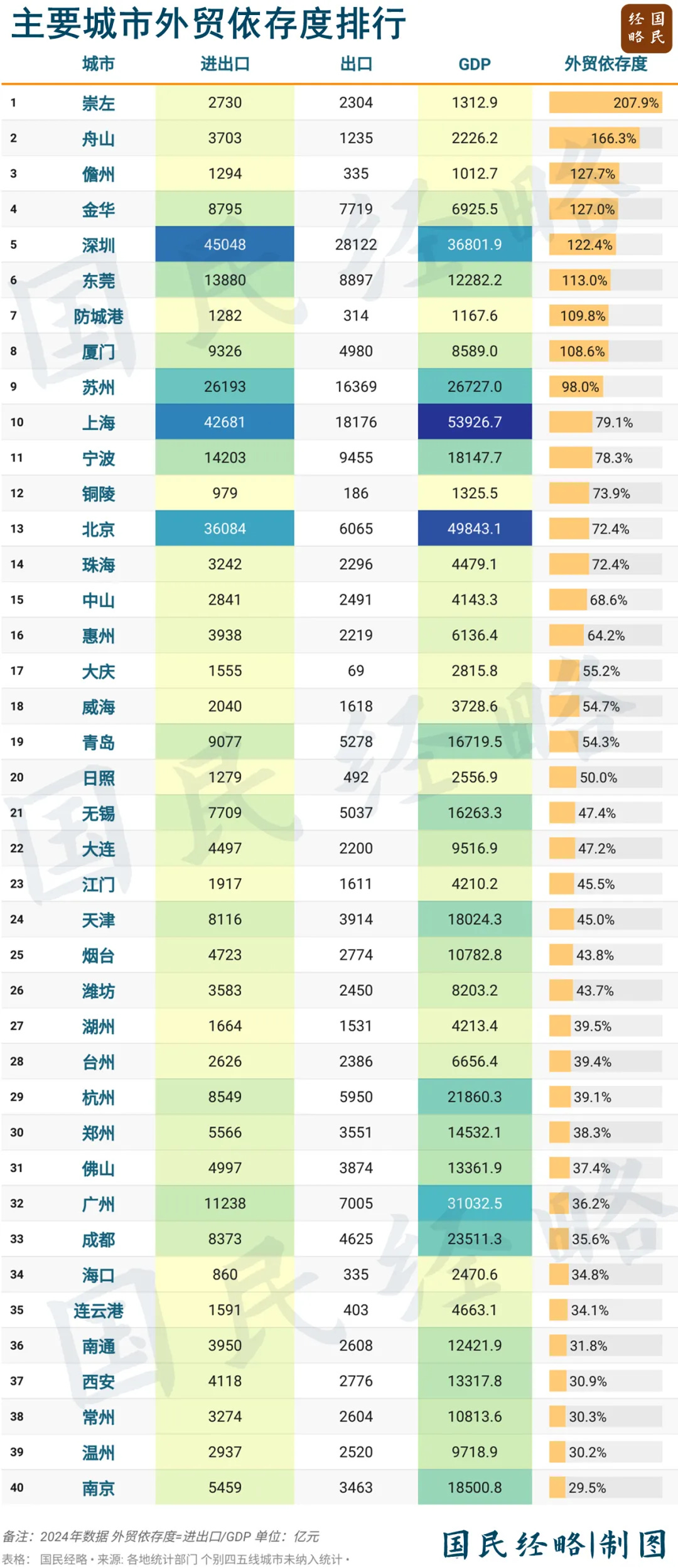

From a national perspective, the top 20 cities with the highest foreign trade dependence are: Chongzuo, Zhoushan, Danzhou, Jinhua, Shenzhen, Dongguan, Fangchenggang, Xiamen, Suzhou, Shanghai, Ningbo, Tongling, Beijing, Zhuhai, Zhongshan, Huizhou, Daqing, Weihai, Qingdao, and Rizhao.

Among them, eight cities—Chongzuo, Zhoushan, Danzhou, Jinhua, Shenzhen, Dongguan, Fangchenggang, and Xiamen—have a foreign trade dependence ratio exceeding 100%.

Notably, Chongzuo and Jinhua are the only two cities where both export dependence and overall trade dependence surpass 100%, reflecting their exceptional level of export-oriented economic activity.

These cities are predominantly located in the eastern coastal region of China and are primarily driven by manufacturing industries. They stand out as major hubs of both foreign trade and industrial production.

This trend is hardly surprising. In the era of globalization, proximity to the sea and access to ports mean closer links to international markets. This is a key factor behind the collective rise of coastal city economies.

What is unexpected, however, is that the city with the highest foreign trade dependence is not Shanghai, Shenzhen, or Suzhou, but the lesser-known Chongzuo City in Guangxi Zhuang Autonomous Region.

Although Chongzuo's total GDP is only at the 100-billion-yuan level, its total foreign trade volume has surpassed that of the provincial capital Nanning, ranking first in Guangxi. Moreover, its foreign trade dependence ratio has topped the national list for consecutive years.

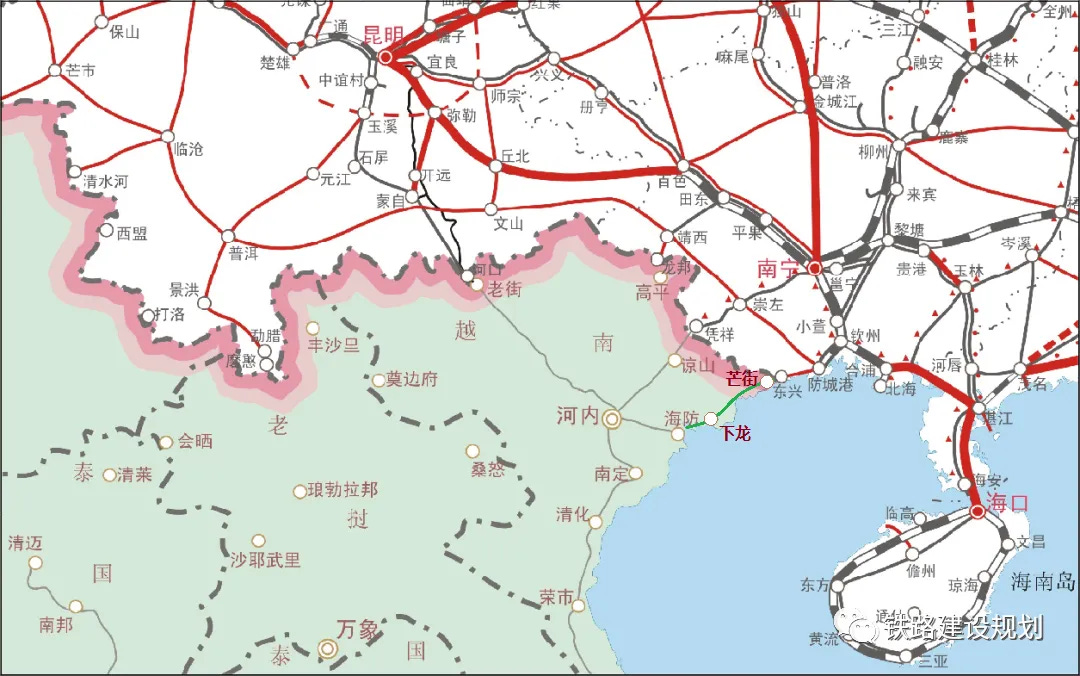

Chongzuo's leading position is primarily due to its proximity to Vietnam, with four counties and cities sharing a border with Vietnam, making it one of China’s most concentrated border port regions. The well-known Youyiguan (Friendship Pass) is located in Chongzuo, which also serves as the starting point of the China–Vietnam railway project currently under development.

Also surprising is that among the top-ranking cities are not only the traditional coastal powerhouses, but also several third- and fourth-tier cities, as well as some inland and northeastern cities.

For example, Daqing in Heilongjiang and Tongling in Anhui—one located in the northeast and the other inland—share a common feature: imports far outweigh exports, and their foreign trade is predominantly driven by resource-related commodities. In Daqing's case, it is mainly crude oil, while Tongling focuses on copper ore.

Beijing presents a similar case. Although its total foreign trade volume ranks among the top three nationwide, more than 80% of its trade is import-based, primarily consisting of bulk commodity imports by centrally administered state-owned enterprises. Crude oil alone accounts for over 40% of the capital's imports.

Therefore, while all these cities can be characterized as “outward-oriented,” the nature of their dependence varies: some are export-driven, others import-heavy; some are more linked to Northeast Asia, while others are tied to broader global markets—resulting in different degrees and types of exposure to external shocks.

While the foreign trade performance of small- and medium-sized cities often reflects their own local dynamics, trillion-yuan GDP cities carry broader systemic importance for the national economy.

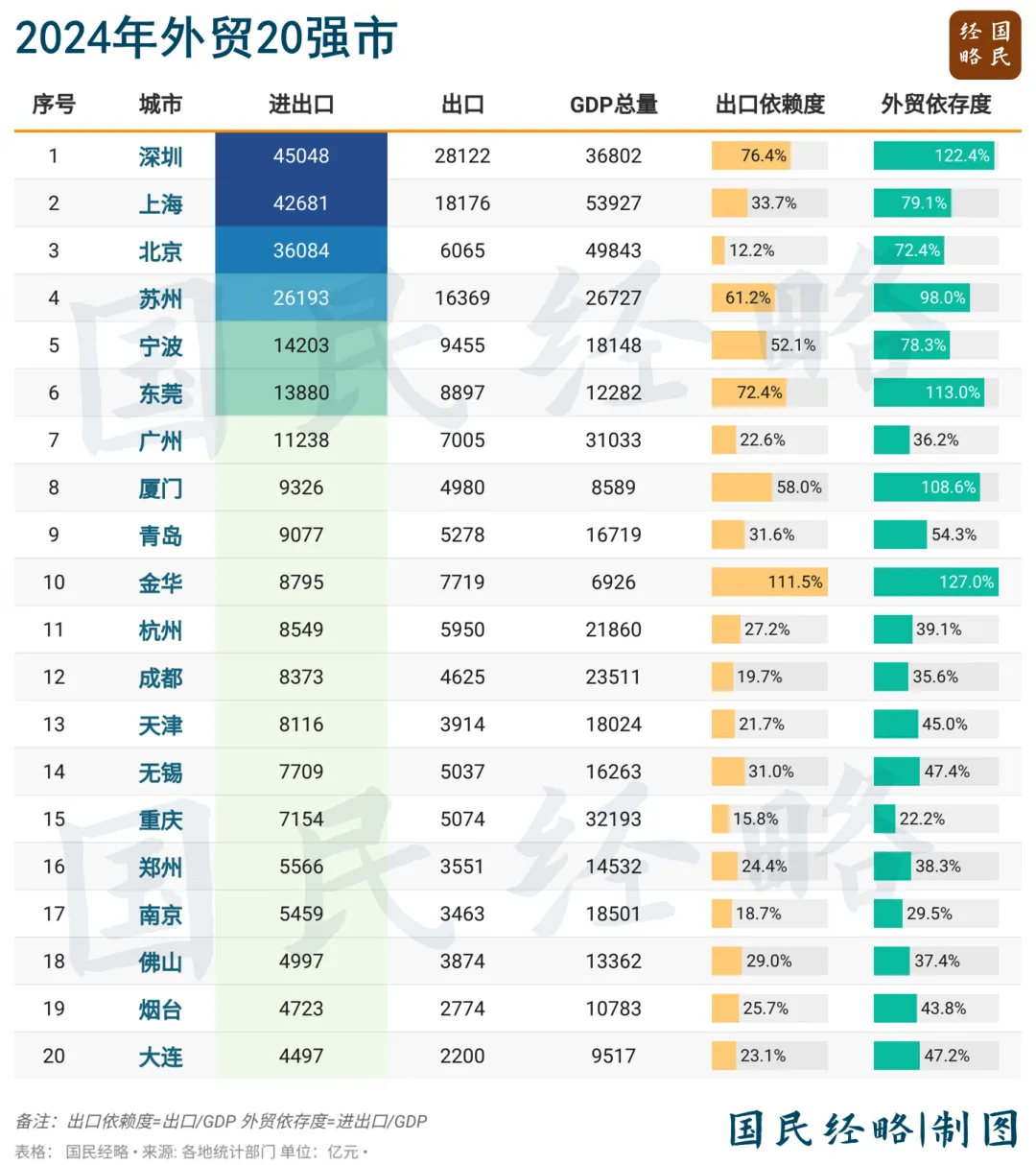

From a scale perspective, China’s top 10 cities in terms of total foreign trade volume are: Shenzhen, Shanghai, Beijing, Suzhou, Ningbo, Dongguan, Guangzhou, Xiamen, Qingdao, and Jinhua.

Among them, Shenzhen and Shanghai have both seen their total foreign trade exceed 4 trillion yuan, jointly accounting for around one-fifth of the national total. The combined trade volume of the top 10 cities accounts for 49.4%, nearly half of the country’s foreign trade.

Expanding the scope to the top 20 cities, their combined foreign trade volume reached 28.2 trillion yuan, with exports totaling 15.3 trillion yuan, representing 64% and 60% of the national figures, respectively—underscoring their strategic weight in the overall trade landscape.

By analogy to the concept of “economically powerful provinces should shoulder greater responsibilities,” these cities may be seen as the ballast stones of China’s foreign trade.

In terms of foreign trade dependence, cities in the top 20 generally have relatively high levels. Jinhua, Shenzhen, Dongguan, and Xiamen each surpass 100%, while Suzhou also reaches a high level of 98%.

Looking specifically at export dependence, Jinhua stands out as the only major city with a ratio exceeding 100%. Meanwhile, Shenzhen, Dongguan, Suzhou, Xiamen, and Ningbo all have export dependence ratios above 50%.

Jinhua’s leading position is largely attributable to its jurisdiction over Yiwu, the world’s largest wholesale market for small commodities and a national center for e-commerce development. Often dubbed the “world’s supermarket,” Yiwu plays a central role in global trade in light manufactured goods.

In contrast, Nanjing and Chongqing have foreign trade dependence ratios below 30%, which are relatively low among major cities. Even Guangzhou, traditionally viewed as a foreign trade powerhouse, has a foreign trade dependence of only 36.2%.

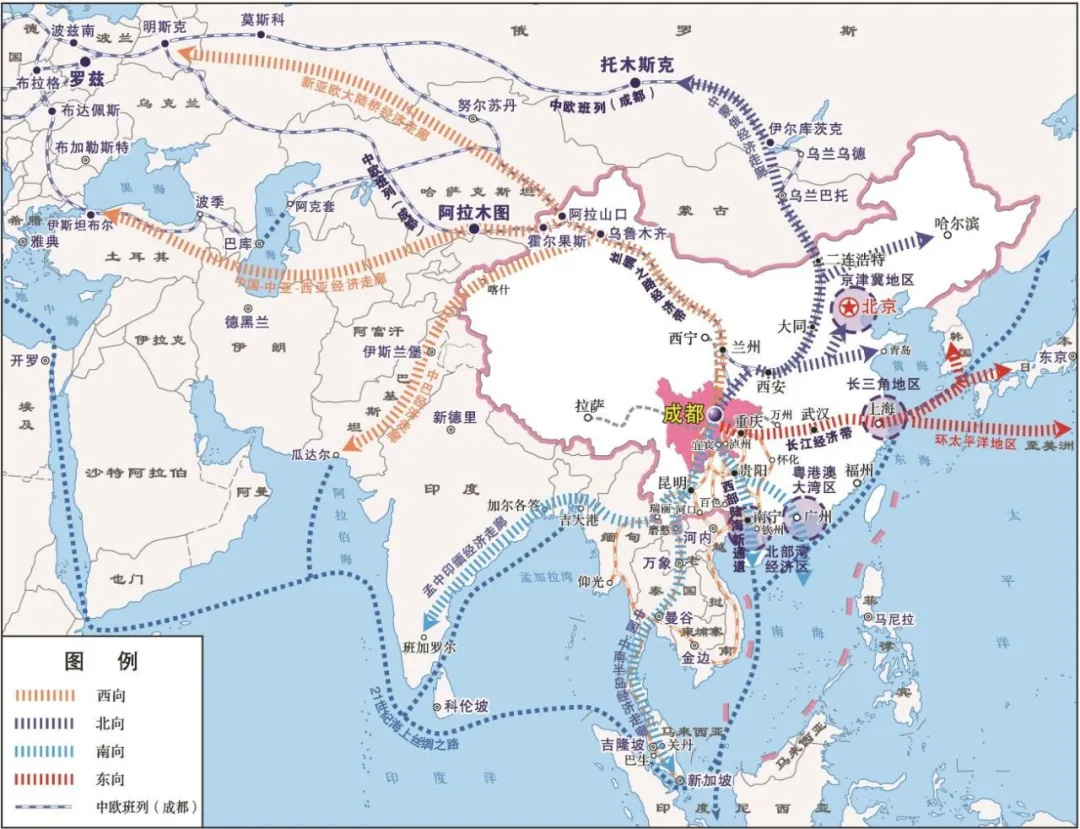

Notably, the list of China’s top 20 cities in foreign trade now includes inland cities such as Chengdu, Chongqing, and Zhengzhou, with Chengdu surpassing the 800-billion-yuan mark for the first time—just one step away from breaking into the top 10.

This remarkable performance is primarily the result of two driving forces: the relocation of industries from eastern to central and western China, and the massive investments in infrastructure. These have enabled the central and western regions to leverage logistics channels such as the China-Europe Railway Express, air cargo routes, and the New International Land-Sea Trade Corridor to emerge as rising stars in the foreign trade sector.

Thanks to the China-Europe Railway Express, electronic products from Chengdu and Chongqing can now be delivered directly to Europe via Central Asia by rail—eliminating the need to travel thousands of kilometers to coastal ports such as Shanghai or Guangzhou.

This trend highlights a critical shift: even inland provincial capitals have now become deeply integrated into global supply chains. No one is immune from the forces of globalization.